Nvidia recently reported its latest quarterly financial results, breaking records and exceeding analyst expectations. The company generated a staggering $26 billion in revenue over the first quarter of 2024, marking an 18% increase from the previous quarter and an astounding 262% increase from the same period last year. The bulk of this revenue, $22.6 billion to be exact, came from its data center business and the soaring demand for AI technology. This represents a 23% increase from the previous quarter and an unbelievable 427% increase from a year ago.

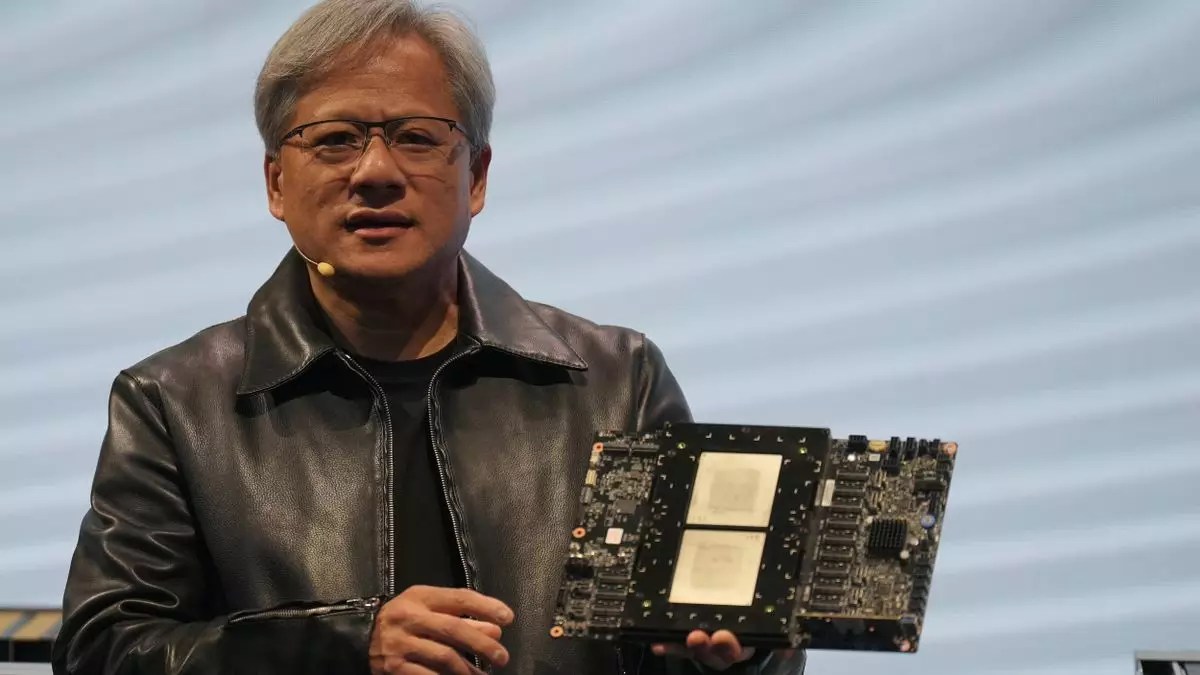

Following these impressive results, Nvidia saw its shares soar above $1,000 in after-hours trading, solidifying its position as the world’s third largest company by market capitalization. Surpassing tech giants like Google’s parent company Alphabet, Nvidia now stands only behind Microsoft and Apple in terms of market cap. CEO Jensen Huang expressed his optimism about the future, emphasizing the transformative power of AI technology in various industries.

While Nvidia’s data center business and AI technologies stole the spotlight with their remarkable growth, it’s important to note that the company also has a significant presence in the gaming industry. Despite a more modest revenue of $2.6 billion from gaming graphics cards, down 8% from the previous quarter but up 18% from a year ago, this segment remains a crucial part of Nvidia’s overall business strategy. With the upcoming release of the Blackwell graphics cards, the gaming division’s performance in the coming quarters will be closely watched.

In a strategic move, Nvidia announced a 10-to-1 stock split, a decision that will dilute the value of each share to a tenth of its original worth. While this move may not have a significant financial impact, it could influence investor sentiment and accessibility to Nvidia shares. Looking ahead, the company is poised to continue its growth trajectory, especially as AI demand shows no signs of slowing down. The development of next-generation AI chips like Blackwell is expected to drive future positive earnings reports for Nvidia.

Despite its recent successes, Nvidia faces ongoing challenges in meeting and exceeding market expectations quarter after quarter. The volatile nature of Wall Street and the ever-changing landscape of technology make it a tough task for any company to sustain such rapid growth. While the future looks promising for Nvidia, the road ahead will require continuous innovation and strategic decision-making to stay ahead of the competition.

Nvidia’s recent financial performance underscores its position as a market leader in the tech industry. With a strong focus on data center solutions, AI technologies, and gaming graphics cards, the company has established a diverse revenue stream that positions it for future growth. As it navigates the complexities of the market and technology landscape, Nvidia remains a key player to watch for investors and industry observers alike.

Leave a Reply